We've wondered here before that in this Performance Guy's opinion/hypothesis, was Oracle always intending to go after BEA and not Business Objects, forcing SAP's hand and tying them up in a costly and lenthy acquisition and integration process while continuing to encircle them with more competitive technology?

We've wondered here before that in this Performance Guy's opinion/hypothesis, was Oracle always intending to go after BEA and not Business Objects, forcing SAP's hand and tying them up in a costly and lenthy acquisition and integration process while continuing to encircle them with more competitive technology?Tuesday, October 30, 2007

Is SAP Too Preoccupied?

We've wondered here before that in this Performance Guy's opinion/hypothesis, was Oracle always intending to go after BEA and not Business Objects, forcing SAP's hand and tying them up in a costly and lenthy acquisition and integration process while continuing to encircle them with more competitive technology?

We've wondered here before that in this Performance Guy's opinion/hypothesis, was Oracle always intending to go after BEA and not Business Objects, forcing SAP's hand and tying them up in a costly and lenthy acquisition and integration process while continuing to encircle them with more competitive technology?Friday, October 26, 2007

PerformancePoint Launch Update

“It’s the total Microsoft solution, not just the BI/PM products... While some competitors will dismiss Microsoft products as not scalable or lacking functionality, that assessment is short-sighted.”

20-Sep New York

9-Oct Chicago

17-Oct Milwaukee

25-Oct Reston

1-Nov Honolulu

6-Nov Pittsburgh

6-Nov Houston

7-Nov Kansas City

7-Nov San Francisco

7-Nov San Diego

7-Nov Seattle

8-Nov Houston

8-Nov Bloomington

9-Nov San Antonio

9-Nov Dallas

13-Nov Omaha

14-Nov Seattle

14-Nov Nashville

14-Nov St Louis

15-Nov Boston

15-Nov Overland Park

27-Nov Downers Grove

28-Nov Madison

28-Nov Des Moines

28-Nov Reston

29-Nov Omaha

4-Dec Columbus

6-Dec Cleveland

6-Dec Los Angeles

The Week That Was, "Margin Call, Gentlemen" Edition...

Microsoft corners the Frozen Concentrated Orange Juice market...

Microsoft corners the Frozen Concentrated Orange Juice market...All due to this guy...

This is not the earnings conference call you're looking for...

DC is back, babee!

Flipcup videos and Facebook nudges totally drive performance--everybody knows that...

A new blogger link to someone far more smarter than us three...

That will do it for us, have a great weekend, we look forward to welcoming Performance Guy Pat up to the great northwest next Monday, when of course, Performance Guy's Nic and Guy will be in Chicago--we just can't win...

The Invisible Earnings Miss...

What if a major BI player missed badly on their earnings and

What if a major BI player missed badly on their earnings andweren't punished for it by the market?

Well that's the scenario that just played out with Business Objects in the past few weeks, as they announced a miss of their earnings on the same day as they announced the acquisition by SAP. Talk about your coincidental timing...

Now of course BOBJ has a fiduciary responsibility to disclose the miss, and do so at the earliest possible time. So I'm in no way faulting the timing. It's just a great coincidence that it was done so as the buried story on the day of the acquisition--which of course prompted the stock to go through the roof.

Now while the Business Objects shareholders didn't take a hit for the miss, one might argue that the SAP shareholders were not so lucky. The 3-4% drop of the SAP stock of course wasn't due directly to the fact that the company they were acquiring had missed their numbers, but moreso that SAP was radically changing its acquisition strategy, which was obviously a bigger deal for long term shareholders.

But back to BOBJ. With the earnings conference call yesterday, a few key nuggets to pick up on from John Schwarz and Jim Tolenen, which were also picked up by other bloggers like Andy Hayler's blog (now linked over on the right) as well:

First, the continued weakness of the core BI, or what's known as Information Discovery and Delivery, part of the business. As others have noted, this showed little to no growth in the quarter, while other companies' core businesses have continued to hum along in the same market conditions that Business Objects found so challenging.

Now I get that the sub prime mortgage mess was a big deal, but they are the first vendor I've seen use this as a prime reason for missing their number. On the other hand, the financial services vertical is the strongest at Business Objects, so maybe it did actually have an effect. But in either case, it's convenient cover. I'll be interested to see if the deals mentioned as Q3 misses actually close in Q4. Often times you hear CEO's, after an early earnings announcement miss, talk about the deals that didn't come in on time but have already closed in the following 3 weeks or so since the pre-announcement, thereby validating their claims that the business is on track, they just has a little slippage. That didn't really happen here.

Second, was this response to a question on the impact of the Cartesis integration on performance management deals in the quarter:

Keith Weiss - Morgan Stanley:

Okay. And then in terms of product, you talked about the distraction from integrating to acquisitions, Cartesis and Inxight in the quarter. Is there any relationship between that comment and perhaps any product focus, where some of the deal focus might have been, was the focus in any particular product segment or is that really across the board?

John Schwarz - Chief Executive Officer:

It's been across the board, but I think your question does have merit in the sense that we have seen some customers asking questions about the overlap between our SRC planning tools and the Cartesis planning tools. And that has contributed to a couple of deferrals and in fact one loss. So, that confusion generated if you will from the overlap was a contributing factor, no question about that.

Expect the competition to make some hay out of that statement, especially since the integration efforts into OutlookSoft/Pilot/SAP are not going to make things any smoother.

The last big news was that BOBJ will not be giving earnings guidance for Q4 and going forward. That seems fair, given the volitility of the integration and the impact that competitive attacks, sales people discounting like heck to clear their pipeline, end of year pull forward--a number of factors.

However, if history repeats itself, I'd expect BOBJ to have a killer Q4; they tend to bounce back in a big way after they miss--although questions on discounts, pipeline, growth, etc. will be interesting to track as they get absorbed into SAP in the next couple of quarters.

Thursday, October 25, 2007

Jaw Dropping...

I know it's not directly the result of the PerformancePoint Server launch, although it's fairly widely acknowledged that our friends in Redmond are doing well in the BI market. But the news today that Microsoft blew out its Q1 earnings targets by over $1 Billion is well, shocking. Suddenly, investing a mere $240M for a share of Facebook doesn't seem like too much money to pay...

I know it's not directly the result of the PerformancePoint Server launch, although it's fairly widely acknowledged that our friends in Redmond are doing well in the BI market. But the news today that Microsoft blew out its Q1 earnings targets by over $1 Billion is well, shocking. Suddenly, investing a mere $240M for a share of Facebook doesn't seem like too much money to pay...The stock is doing well in after-hour trading, which you might expect, and has given the company their biggest single day stock jump in years.

Facebooked!

This move is all about eyeballs and follows Microsofts acquisition of aQuantive ($6 billion, the largest in Microsoft history) to aggressively move into the advertising space and compete directly with Google. To try and bring this home, yes I know it’s a stretch, but this is somewhat relevant to BI as we see the overall category of communications and collaboration expand. Sites like Myspace and Facebook are using the technology as a platform to communicate information, search on information, allow users to post information about themselves, all of which is collected and organized and optimized to bring relevant, meaningful content to the users and create a greater sense of community. The massive amounts of data on all of these sites is also forming a kind of digital history, unlike that of any other generation. Just think, the future president of the United States likely has a Facebook page with him playing flip cups with his buddies somewhere out there right now!

Friday, October 19, 2007

The Business Objects EPM Strategy

The Week That Was...

MicroStrategy spins the SAP/BOBJ acquisition...

New Crystal Reports 2008 edition comes to the market...

Cognos! Podcasts! Party!

Carbon offsets for everyone!

Well that will do it for us this week, have a great weekend and we'll be back on duty on Monday!

PG's

Wednesday, October 17, 2007

Personal Intelligence Gets Gamers Excited

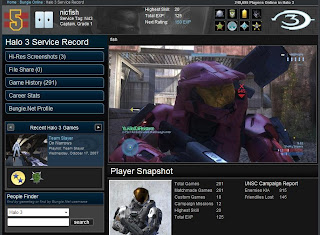

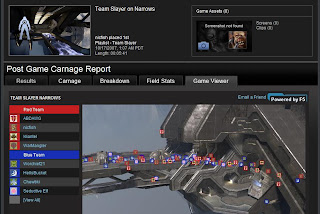

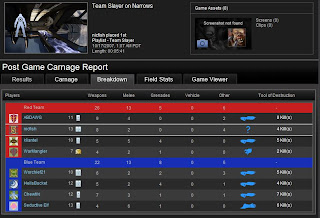

To illustrate the point I have an example that was forwarded to me by one of my gamer friends. The example is from the recently released xbox video game Halo 3. Gamers can log onto the Bungie.com website, (these are the guys that make Halo) and see personal information about their Halo 3 game play. Detailed information on each individual game is provided including things like who died the most, who had the most kills, which weapons were most effective. All of this information that gets stored on the gamers own personal xbox live account and is served up to them through an online dashboard via the Bungie website. As gamers play online against each other they can track their performance and work their way through various levels of achievement, a type of Halo performance management if you will.

This example demonstrates many of the same concepts we see in the business world, as this is essentially a dashboard serving up particular user specific information that you can monitor and do deeper analysis to ultimately improve your own game play. This type of analysis leverages BI technology but in a very different way that impacts the overall experience of a game. Check out Bungie’s website, http://www.bungie.net/stats/default.aspx and put the name: nicfish into the people finder to see an example.

Tuesday, October 16, 2007

The Microstrategy POV on the SAP and Business Objects Deal

| Significant Areas of Product Overlap Between Business Objects and SAP | ||

| Product Category | Business Objects | SAP |

| Dashboards and Scorecards | Xcelsius, Dashboard Manager, Crystal Vision | Visual Composer, Web Application Designer |

| Query, Analysis and Reporting | Web Intelligence, OLAP Intelligence, Voyager, Crystal Reports, Cartesis, Inxight Software | BEx Web Analyzer, BEx Analyzer, ABAP™, BEx Report Designer, Pilot |

| Office Plug-ins | Live Office | BEx Analyzer |

| Application Infrastructure | Nsite (on demand), crystalreports.com Vertical and Horizontal Apps | NetWeaver xApps Vertical and Horizontal Apps |

| Desktop Design Tools | Desktop Intelligence, Designer | BEx Query Designer |

| Portals | InfoView | SAP NetWeaver Portal |

| Performance Management or CPM | SRC, ALG Software, Cartesis | SEM-BCS, BPS, Netweaver® BI-Integrated Planning, OutlookSoft, Netweaver® BI Advanced Planner and Optimizer, mySAP ERP Express Planning |

| Master Data Management | Metadata Manager, Composer | SAP NetWeaver® Master Data Management |

| ETL/EII/EIM | Data Integrator (Acta), Data Federator (Medience), Data Quality (Firstlogic, FUZZY! Informatik) | Data Extraction routines to populate SAP BI |

| Mobile | Mobile Interactive Viewing (InfoView Mobile) | SAP NetWeaver® Mobile |

Source: Microstrategy website. Link is HERE.

Source: Microstrategy website. Link is HERE.Also of interest is the fact that this is not totally complete or accurate. For example, there is no mention of the Dashboard Builder or Performance Manager as part of the dashboard and scorecard offering in box one. However, they do give at least one overview of the variety of overlap. As of this writing, no analyst or 3rd party has provide a similar side by side comparison that I have seen.

If I was SAP and Business Objects, I would fully expect to see this in wide circulation in competitive deals.

HAVE We Really Ever Seen a Report Do This Before???

The PG's most talented videographer friend, Philip Smeed, checks in with a new promotional video from the Business Objects Insight Conference (wow, is this the "last" Insight Conference EVER?) introducing the next generation of Crystal Reports, now titled Crystal Reports 2008.

The PG's most talented videographer friend, Philip Smeed, checks in with a new promotional video from the Business Objects Insight Conference (wow, is this the "last" Insight Conference EVER?) introducing the next generation of Crystal Reports, now titled Crystal Reports 2008.While we'll leave the product reviews to the tech experts, there's no question that Philip is at the top of his game in producing this slick preview of the next generation of the industry's leading reporting product. Check it out on the Business Objects website here.

Monday, October 15, 2007

So Just What IS this New Category Called Then?

Interestingly, the more you hear about how SAP is going to operate Business Objects, the less likely it seems to be sustainable over any period of time. For the last 18-24 months we've been hearing about the consolidation of the industry we're now experiencing, and that MSFT, SAP, ORCL, maybe IBM, would all have a share. And so it's coming to pass (we'll assume that given even Cognos is now not confirming that they'll be around forever) that IBM is the 4th one in the mix).

Is it really realistic to think that Business Objects, "an SAP company," is going to be able to disassociate with its parent in non-SAP shops where they're in a competitive deal? Any chance SAP is going to let Business Objects keep developing new connectors to Oracle ERP and Hyperions CPM for the betterment of "independent BI?" I'm not so sure. The other Three from above will go to great pains to paint Business Objects as nothing more than an extension of SAP, lumping all the things that Business Objects does as SAP technology (with one heck of a product roadmap, but that's beside the point). So while the marketing may stay unique, the "black is the new black" look and feel may stay in place, conventional wisdom is already coalescing around the idea that if you're an SAP shop, you'll go with BOBJ; if you're something else, you'll go with something else (We'll leave the question of "what if you're none of the above" to another time).

So that leaves Four big tech vendors all with BI and performance management functionality resident within their offerings, but not at the core of them. Which means that we're in another category of technology. As BI is consumed into the overall portfolio of these companies, it follows that these offerings, along with all the resident technology, must add up to something new. But what is it?

Little noticed last month was the acquisition of former CPM leader Longview Solutions by a Dutch company called Exact Software. Longview was once a high-flyer when CPM was new, and had the potential to be what other vendors ultimately achieved. Last month they were sold for $50M, a fraction of their competition's selling prices. In the acquisition press release, Exact conjures up a new term to describe what they now do with their ERP, CRM, and now, CPM portfolio--Business Empowerment.

So is that our new category name here? Business Empowerment? Seriously?

Ugh...

BI - Is it over that it is Over?

After a week of market gyrations about SAP and Business Objects, not to mention the "he said, he said" Oracle and BEA activity of Friday and into the weekend, you have to wonder if maybe the real news here is that BI is done a category. A little more on that and a couple ob

I find it somewhat surprising that both Business Objects and SAP have gotten such crappy market respon

A couple of SAP moves are also smart - stand alone company,

Maybe the bigger ob

Also of interest is Oracle playing with the BEA bunny and BEA swatting back and saying no thanks. Goldman Sachs is running a "process" for BEA to

Friday, October 12, 2007

The Week That Was, Walldorf Edition...

We're starting a new feature here on the Performance Guys to give our passers-by a quick recap of what happened this past week in the world of Performance Management. Off we go with the first addition of TWTW:

We're starting a new feature here on the Performance Guys to give our passers-by a quick recap of what happened this past week in the world of Performance Management. Off we go with the first addition of TWTW:The Germans are coming, the Germans are coming!

The acquisition is great news!

The acquisition is horrible news!

What's this "business user" segment you speak of, sir?

Mr. Ashe? I have IBM for you on Line 1...

Could Larry really be that sneaky? NAAHHHHHHH...

Wow, what a week! We'll see you on Monday--

PG's

Did Oracle Just Trump SAP?

An interesting theory I was discussing with Performance Guy Nic this morning regarding the news that Oracle has made an unsolicited bid (now rebuffed) for BEA Systems of about $6.7B. This is not the first time Oracle has gone after its competitor in the middleware market, but with the internal turmoil at BEA right now, and the performance of the stock (not to mention the 13.2% stake held by Carl Icahn), the timing couldn't be better.

An interesting theory I was discussing with Performance Guy Nic this morning regarding the news that Oracle has made an unsolicited bid (now rebuffed) for BEA Systems of about $6.7B. This is not the first time Oracle has gone after its competitor in the middleware market, but with the internal turmoil at BEA right now, and the performance of the stock (not to mention the 13.2% stake held by Carl Icahn), the timing couldn't be better.Now SAP is really on the defensive here, with so much cash and focus now tied up with a long integration with Business Objects, are they in a position to counter the Oracle bid? Not withstanding other competing bids that are likely to come in for BEA now that there's an offer out there (IBM and HP come to mind), SAP may be left on the outside of this market if they let Oracle win.

Interestingly, what if this was Oracle's plan all along? Everyone knows of Oracle's interest in Business Objects throughout the year; what if they were making noises of varying degrees about being interested again with the intent of baiting SAP to make its move, all the while having no real intention to buy Business Objects, but having BEA as their main goal all along?

They saddle their nemesis with a lengthy and arduous integration and cash commitment, they scoop up a hugely competitive vendor and take over more of the infrastructure play, and SAP is again on the sidelines playing catch-up.

I'm just saying is all...

Wednesday, October 10, 2007

Does Business Objects Really Help SAP get at the "Business User?"

On the face of it, I get it. SAP is basically saying that their core ERP user has most of the ERP they need, and there's only so many ERP users out there, so in order to double their addressable market, they need to expand beyond their traditional user constituency. Everyone pretty much has an ERP system at this point, it's heavily customized, and organically adding on new functionality doesn't get them their growth targets. So great, let's get more into this new business user segment that shows some promise, which to date has been where their own performance management products have resided.

But do the core Business Objects products really help SAP get closer to the business user? The mantra of the BI vendors for the past 4-5 years (at least) is that their systems help unlock the data and information that business users need (so far so good). But then in the next breath, they say that the potential BI user population is only 20% (or so) penetrated; and they, by their own admission, haven't been able to expand the pie any further themselves with their traditional BI tools. So the very business users they proport to want to help are not using the products today.

So who IS using these tools? Well, we know that IT does; they do a lot of work on the reports, adminsitration, security, and integration of the product. But they're not business users. And if they're doing this for Business Objects, they're doing it already for ERP/SAP as well. So no one new here. We know business analysts do, they're certainly business users; they use the pivot tables, cubes, etc., to analyze the information from the data warehouse and universe and look for trends, etc. But there are relatively few of these analysts in a company today, and they're already likely using their ERP system to get out the data, look at orders, forecasts, maybe even financials. So that's not necessarily a net-new user for SAP either; in fact, like the IT user, they may be already counting this user in their population as well. And even if it is, it's a negligible addition to the potential user population.

Well what about the people for whom all these reports and analysis is created--are they are elusive business user? I'm not sure. Would we say they're' "users?" Perhaps in the technical sense, in that they are "using" the information that IT or the analyst is creating to help them run their business. But they're really not using the BI tool or app, just getting information delivered to them. Are they more likely to use Business Objects or a BI tool now that BOJ is part of SAP than when it was independent--i.e. is this an untapped user population? I just don't think so. They're not attached to BI, they don't care where it comes from, they're fine with what they're already getting (or not, but you get my point). So that's not a net-new segment either.

Which brings us to performance management. Here, I'd argue, is the one place where BI companies have been branching out in recent years to hit the line-of-business person, the business decision maker, the CFO, whoever--the audience that SAP is calling "the business user." Cognos led the charge with its performance management initiatives 5 years ago, and everyone else has been playing catch up since them. Including Business Objects. And SAP.

So if this is really where they see the best opportunity to grow into a new segment, someone who will not produce data for others, not just get a report in their inbox, but actually run their business through the BI tools and applications, then I agree, this is where we find a business user.

But isn't this precisely where SAP has already invested, acquired, begun integration, and has almost a 100% product overlap with Business Objects? The BOBJ performance management customer base is pretty small (relative to their BI customer base). So SAP is not getting access to a new built-in business user customer segment that helps them expand the pie. Additionally, the SAP performance management product line-up is already on the way to being integrated into the SAP architecture. So how does adding the only applications really "used" by a business user to a portfolio that already has them (and good ones at that) actually expand the pie? Won't the "business user" product portfolio basically look the same as it does today once integration is completed?

Now please don't misread this as sour grapes on the acquisition or naivity in terms of thinking that this acquisition won't work. To the contrary, SAP was far from successful at weaning itself from the Crystal environment, and SAP users will certainly benefit from the great tools and apps that Business Objects wil provide. I get that part, and I think that SAP shops will have great tools at their disposal.

But saying that BI is for business users flies in the face of the core buying audience and users of Business Objects BI products today. They're selling to IT; IT is the main user, not a business person. The business person is mainly a consumer. The main business users are in the field of performance management, which SAP was already well on the way to doing on its own.

So how is that an expansion?

Tuesday, October 09, 2007

Was the Object to Buy or to Sell?

Many folks around the industry are scratching their heads about this acquisition, a few years ago it would have made a lot more sense for SAP as they partnered heavily with the software company to complete a BI offering that they couldn’t offer customer. Crystal Reports played heavily into the SAP offering to allow customers to leverage data within R3. But over the past few years the relationship has fallen to the wayside as SAP has become more aggressive in the space, releasing a host of BI applications and driving the premise of BI and business process with the extension of their Net Weaver platform. Not to mention the amount of technology overlap when you through in OutlookSoft, Cartesis, ALG, and SRC planning and budgeting technologies into the mix.

So the $7 Billion announcement might not be all good gravy on this past Canadian Thanksgiving holiday weekend but the acquisition does add a significant amount of power from a territory standpoint. SAP effectively puts a stamp on owning Europe in the enterprise software space. Throw in the recent acquisition of Cartesis by Business Objects and you certainly start to get the feeling we are back in the Roman empire. This is great news for customers, as the market consolidates they will be able to take advantage of more affordable software and simply deal with fewer companies.

If we take a minute to think about the cause and effect much of the cause of the this acquisition, from the initial onset it would appear this is clearly a move that allows SAP to add to their solution portfolio to become more competitive against Oracle. This makes sense, especially when you consider Business Objects has announced that they will continue their heterogeneous strategy allowing SAP to get their tentacles into customers where they wouldn’t normally be, ie. a Trojan horse on steroids. But before we jump to the obvious could there be other factors at work here, could this acquisition be more about Business Objects wanting to be sold than SAP wanting to drop $7 Billion on a ton of overlapping technology. The move was a significant one, but simply another piece of a puzzle that has been developing for the past 7 years.

A short history

Monday, October 08, 2007

The "Business User" Segment

As the news of the SAP acquisition of Business Objects continues to filter in, one term, new to this Performance Guy, keeps popping up throughout the articles and press conference today--the "Business User." It seems to be a new term to the analysts that follow SAP as well, representing a 3rd-wheel of strategy that is more acquisition friendly for SAP than their core businesses. It's in this third area that SAP apparently intends to continue to branch out with other acquisitions and new technologies (OutlookSoft for instance), and Business Objects is likely to be the cornerstone of this strategy moving forward.

As the news of the SAP acquisition of Business Objects continues to filter in, one term, new to this Performance Guy, keeps popping up throughout the articles and press conference today--the "Business User." It seems to be a new term to the analysts that follow SAP as well, representing a 3rd-wheel of strategy that is more acquisition friendly for SAP than their core businesses. It's in this third area that SAP apparently intends to continue to branch out with other acquisitions and new technologies (OutlookSoft for instance), and Business Objects is likely to be the cornerstone of this strategy moving forward.Sunday, October 07, 2007

Well THAT Didn't Take Long

News breaking that the hammer has finally dropped on the long rumored SAP/Business Objects takeover, with the announcement of the $6.8B deal today. Even though this possibility has been talked about for months, it's still somewhat of a surprise to see the news, as well as the amount of the transaction, which is quite a premium for BOBJ stockholders.

News breaking that the hammer has finally dropped on the long rumored SAP/Business Objects takeover, with the announcement of the $6.8B deal today. Even though this possibility has been talked about for months, it's still somewhat of a surprise to see the news, as well as the amount of the transaction, which is quite a premium for BOBJ stockholders. Other releases out talk about little restructuring at the outset, and of some of the senior management appointments, particular about Bernard Liautaud and John Schwarz on the SAP Executive Committee. Additionally, SAP will operate Business Objects as a "stand alone" entity, which makes sense since most BOBJ customers utilize both SQL Server as well as Oracle as their database infrastructure.

Other releases out talk about little restructuring at the outset, and of some of the senior management appointments, particular about Bernard Liautaud and John Schwarz on the SAP Executive Committee. Additionally, SAP will operate Business Objects as a "stand alone" entity, which makes sense since most BOBJ customers utilize both SQL Server as well as Oracle as their database infrastructure.Friday, October 05, 2007

Friday Deep Thoughts

The rise of Dynamic Applications

This is Forrester's new term that encompasses their view about the next generation of business applications that are "designed for people, and built to change." While the internal camps at Forrester are not aligned on this position, their entire technology leadership conference last week was built to the theme and exceed expectations for attendance. If you want the snapshot, check out Sandy Kemsley's overview for Intelligent Enterprise of Connie Moore's keynote here.

The net is that Forrester talks about the intersection of process management (BPM - the real one), business rules, Business activity monitoring (BAM) and information workplace. In real life, both the conference and reality of this approach is all about rapid development of business solutions. This is process management with customized interfaces. The top tier of BPM vendors already have all this capability in their product. Bolt on to Windows, add a mash-up, customize and you are off to the races. Did I mention it works with the stuff you own like ERP and CRM? The insight here is that you can and should be able to build something specific to your business needs quickly, make sure the interface does not suck, and be able to use it to operate your business. Sounds like what all the tech folks have been talking about for years may finally have arrived.

Look mom, we do SaaS too. Or, I will see your acronym and raise you one

In the same week in late September on opposite coasts, Salesforce.com and SAP roll out the NEW future of applications and platform on demand. Coincidence? I think not. In the red corner, the always allegedly revolutionary team Benioff rolled Force.com, to be an on-demand platform for application development. This was accompanied by a George Lucas sighting, which always gets a certain segment of the tech community (namely those with storm trooper outfits and action figure collections) especially hot and bothered. They also added in new whizzy "build your own interface" capability called Visual Force. The fully quote compliant Benioff referred to SAP as "innovation free". Score one point for team, "no software, but we are introducing an on-demand platform to build applications and yet another new branding scheme".

In the blue corner, team SAP introduced new SaaS Business By Design, which was formerly code named A1S at Hassofest and early press and AR briefings. Among the things of interest here is that Deputy CEO Leo Apotheker taking direct shots at Salesforce in public and comparing SAP's SaaS offer to a three star meal and Salesforce to hors d'oeuvres. So SAP is full course menu and Salesforce is pushing pigs in a blanket?

Apotheker in eWeek:

"Our attempt is to get rid of all the acronyms. Businesses don't buy acroymns, they buy process flow, a business model...we provide a complete suite - lock, stock and barrel."Among the things to consider here; if SAP is Business By Design is 3 star, what does that imply about all the other things in their offering? Are they going jargon free? What do they actually do about process? Why are people calling it B2D? I thought we were done with acronyms. At least the blue squad now has someone else prepared to talk trash, a capability missing since Shai Agassi decide clean cars, clean energy and venture money were more fun than software. Check Shai's blog to get an update on animal life and family vacation in the Galapagos.

Performance Management - Got Game?

Think you have the skills to lead a global organization and take control of a leading brand? If so, try your hand running McDonald's here. While there is an obvious political slant to the game, the are also some obvious real world realities to consider in management of this sort of global operation. Don't be surprised if you don't win the first time you play. Or at all. You aren't supposed to win.

Have a good weekend.